This book provides a comprehensive commentary on how GST intersects with key allied laws—from the Contract Act and Sale of Goods Act to RERA and beyond—offering updated legislative references and judicial insights. It clarifies how these statutory definitions and principles shape GST liabilities, classifications, and dispute outcomes, with illustrative examples and practice notes. Each chapter systematically integrates core concepts, addresses interpretational challenges, and guides readers on applying them in practical scenarios. Its organised structure and cross-references make it indispensable for practitioners, businesses, and students seeking an in-depth understanding of GST's legal underpinnings. It is a user-friendly and authoritative guide to navigating GST's multifaceted legal landscape.

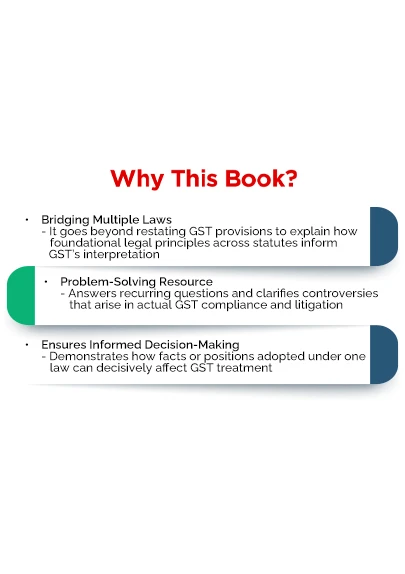

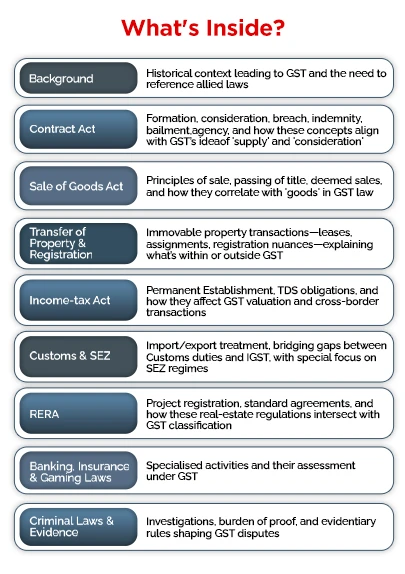

This book presents a comprehensive commentary examining the practical interplay between the Goods and Services Tax (GST) and the vast array of laws surrounding it. This work goes beyond a simple restatement of statutes by delving into how allied laws—ranging from the Contract Act, Sale of Goods Act, Transfer of Property Act, Income-tax Act, Customs Act, to Real Estate (Regulation and Development) Act, and many more—impact and clarify GST's application and interpretation. It is designed to address the day-to-day questions and controversies in GST practice; it highlights how each allied law can influence the outcome of a GST dispute or compliance position. It highlights how facts asserted under one law can become decisive when tested under GST or vice versa. With updated legislative references and notable judicial precedents, this commentary acts as a road map for professionals, businesses, and students seeking a structured, in-depth analysis.

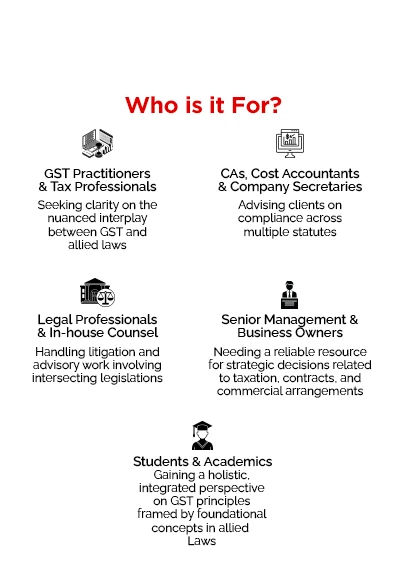

This book is intended for the following audience:

- GST Practitioners & Tax Professionals – Seeking clarity on the nuanced interactions between GST and allied laws

- Chartered Accountants, Cost Accountants & Company Secretaries – Needing an authoritative guide to advise clients and manage compliance across multiple statutory obligations

- Legal Professionals & In-house Counsel – Navigating litigation and advisory mandates involving multiple pieces of legislation that intersect with GST

- Senior Management & Business Owners – Desiring a dependable resource to make informed strategic decisions about taxation, contracts, and commercial arrangements

- Students & Academics – Aiming to get an integrated understanding of GST principles framed by the foundational concepts of allied laws

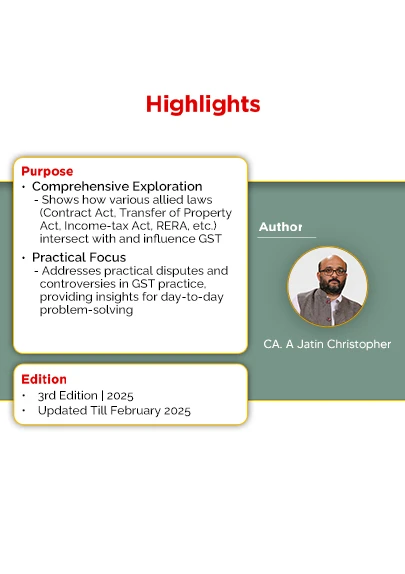

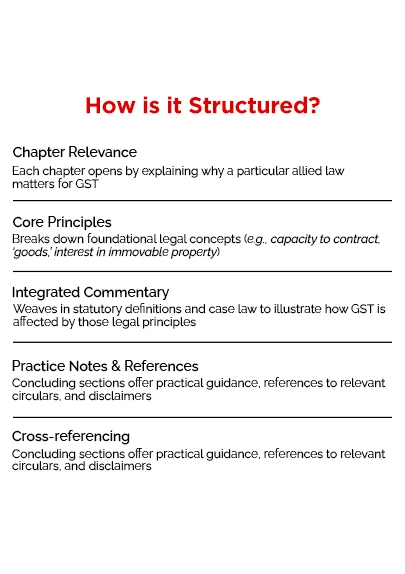

The Present Publication is the 3rd Edition | 2025 and has been amended upto February 2025. This book is authored by CA. A Jatin Christopher with the following noteworthy features:

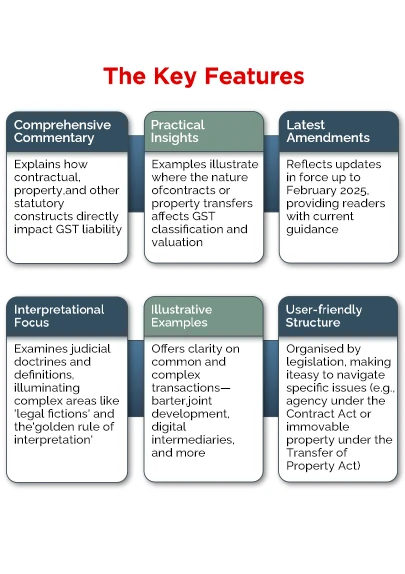

- [Comprehensive Commentary] Explains how allied laws form the legal backdrop for GST, shedding light on how contractual, property and other statutory constructs play a direct role in determining GST liability

- [Practical Insights] Illustrates practical scenarios where positions under allied laws (like the nature of contracts, property transfers, or partnership structures) have direct implications on GST classification, valuation, and eligibility for credit

- [

No review given yet!